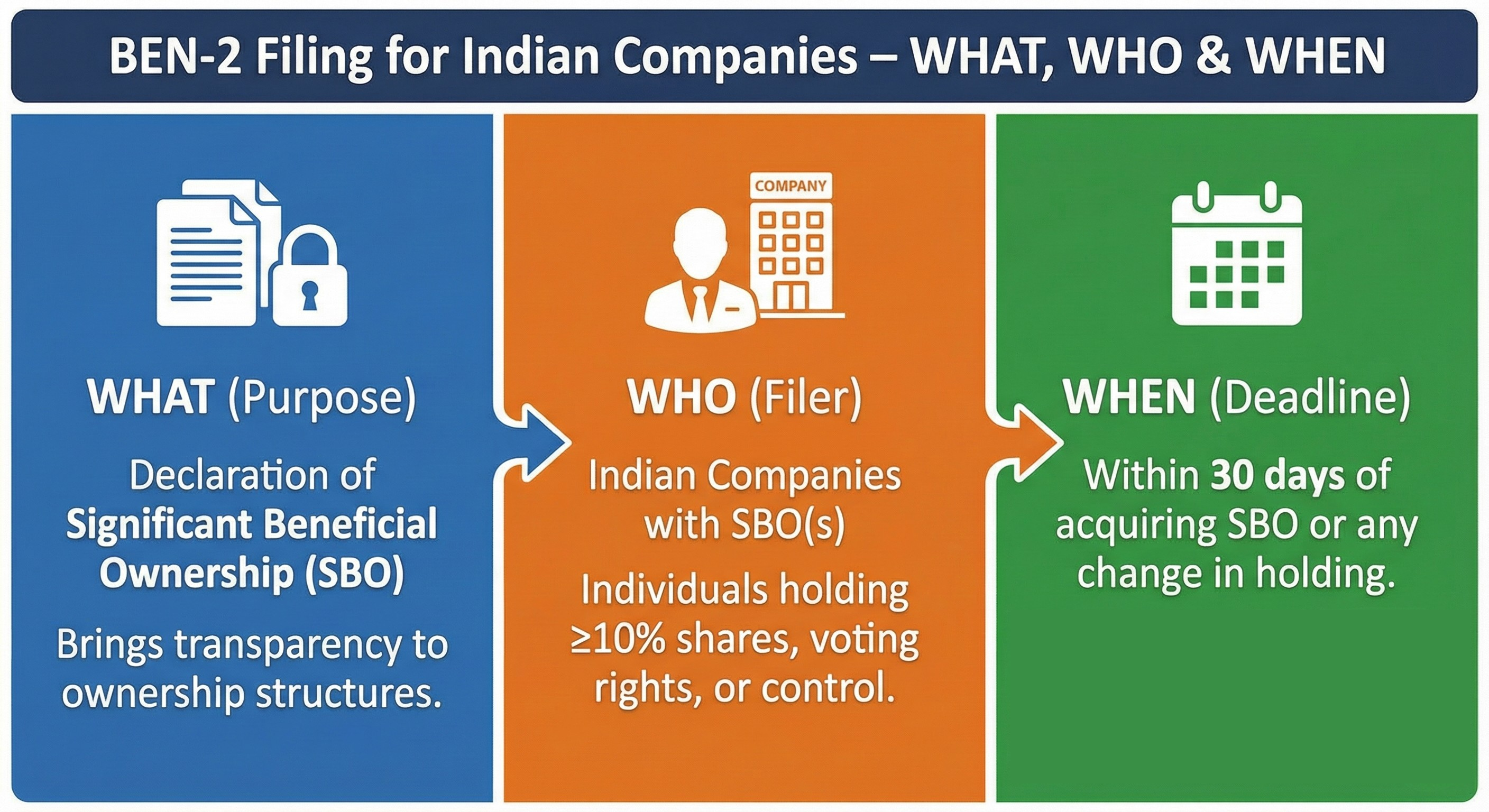

BEN-2 Filing for Indian Companies – WHAT, WHO & WHEN

Form BEN-2 is one of the most scrutinised ROC filings under the Companies Act, 2013. With increasing focus on transparency and identification of real owners, Indian companies must clearly identify when BEN-2 is applicable, who qualifies as an SBO, and how to comply correctly.

This article explains BEN-2 filing in a practical, audit-ready manner.

1. What is Form BEN-2?

Form BEN-2 is filed by an Indian company with the Registrar of Companies (ROC) to report details of its Significant Beneficial Owner (SBO).

BEN-2 is in line with international practice followed by various countries to identify persons with significant control like PSC Register in UK, BOI Reporting in US and UBO Registers in European Union and many others.

In India it is mandated under:

Section 90 of the Companies Act, 2013, and

Companies (Significant Beneficial Owners) Rules, 2018

The form is filed only after the company receives Form BEN-1 from the SBO. The first onus is on SBO to provide company with BEN-1 and then the company needs to file BEN-2 with ROC.

2. Objective of BEN-2

The intent of SBO provisions is to:

identify the ultimate natural person behind non-individual shareholders,

prevent misuse of layered structures,

enhance corporate transparency, and

align Indian law with global anti-money laundering standards.

3. Who is a Significant Beneficial Owner (SBO)?

The most important question now is who is Significant Beneficial Owner (SBO)

Under Section 90 of the Act and the SBO Rules, 2018, SBO is an individual who, directly or indirectly, holds 10% or more of:

shares, or

voting rights, or

right to receive distributable dividend, or

exercises significant influence or control.

[other than solely through direct holdings, for example, Individual holding more than say 50% shares in a company in his/her own name will not qualify as SBO.]

Only individuals can be SBOs. Companies, LLPs, trusts, or funds can never be SBOs themselves.

4. When is BEN-2 filing applicable?

BEN-2 is applicable only when an SBO is identified.

Common situations where BEN-2 applies:

Shareholding through company / LLP / partnership

Holding via foreign entity

Ownership through trust structures

Multiple layered holding entities

Control or influence without majority shareholding

So, share holding in a company via corporate structure would attract filing of BEN-2. The main purpose of BEN-2 is to identify the ultimate share holder who is holding more than 10% of in the company via shares, voting rights etc.

5. When BEN-2 is NOT applicable

BEN-2 is not required in the following cases:

Shares held directly by an individual (Indian or foreign)

No individual holds 10% or more indirect interest

Shareholder is an LLP or company but no ultimate natural person crosses threshold

In such cases, the company should issue BEN-4 notices and maintain internal working papers.

6. BEN-2 in case of LLP shareholding

If an LLP holds shares in a company:

Company should Identify individual partners

Check which partner (if any) holds more than 50% capital or profit share in the LLP

Calculate indirect holding at company level

If indirect holding ≥10%, that individual is SBO and BEN-2 must be filed.

Individual should submit BEN-1 to the company for further compliance at company level

7. Timeline for BEN-2 filing

Event

Due date

Receipt of BEN-1 from SBO

Day 0, Immediately

Filing of BEN-2 with ROC

Within 30 days

Change in SBO details

Within 30 days of change

Late filing attracts heavy penalties. Compliance should be done in a timely manner to avoid late fees and penalties.

8. Information & documents required

Details in BEN-2:

Company CIN, name and address

SBO personal details (name, DOB, nationality)

PAN / Passport number

Nature and extent of beneficial interest

Date of acquiring SBO status

Attachments:

Form BEN-1 declaration

Ownership / shareholding structure (recommended)

9. Penalties for non-compliance

Failure to comply with SBO provisions may result in:

Company penalty: ₹1 lakh to ₹10 lakhs

Continuing default: ₹1,000 per day

Officers in default may also be penalised

Due to high penalties as compared to other ROC filings, BEN-2 is considered a high-risk ROC compliance.

10. Practical compliance tips

Always prepare an SBO identification working paper

Do not rely only on shareholding register

Check indirect and foreign holdings carefully

Careful assessment in case of foreign corporate investments

If there are other than individuals in shareholder list, it requires diligent identification

Issue BEN-4 notices proactively

File BEN-2 only when SBO is clearly identified

11. Statutory Provisions

Section 90, Companies Act, 2013

Mandates declaration and reporting of Significant Beneficial Owners and empowers companies to seek information from members.

Rule 2(h), Companies (Significant Beneficial Owners) Rules, 2018

Defines "Significant Beneficial Owner" and prescribes the 10% threshold for shares, voting rights, dividend entitlement, or significant influence/control.

Rule 3 – Declaration by SBO

Requires every SBO to file Form BEN-1 with the company within 30 days of acquiring or changing SBO status.

Rule 4 – Filing by Company

Obligates the company to file Form BEN-2 with ROC within 30 days of receipt of BEN-1.

Rule 6 – Notice seeking information

Authorises the company to issue Form BEN-4 where SBO information is not known or not provided.

Conclusion

Form BEN-2 is not a routine filing. It requires careful analysis of ownership structures, especially where LLPs, foreign companies, or trusts are involved. Indian companies should adopt a documented, methodical approach to SBO compliance to avoid penalties and ROC objections.

If in doubt, it is always better to document reasons for non-applicability rather than assuming as not applicable.

PRACTICAL GUIDE QnA

FAQ 1: Is BEN-2 required if shares are held directly by an individual?

No. If shares are held directly by an individual (Indian or foreign), SBO provisions do not apply and BEN-2 is not required.

FAQ 2: Is BEN-2 applicable if the shareholder is an LLP?

BEN-2 is applicable only if an individual partner of the LLP ultimately holds 10% or more indirect interest in the company.

FAQ 3: Is BEN-2 required if no SBO is identified?

No. If no individual qualifies as SBO, BEN-2 should not be filed. The company must issue BEN-4 notices and maintain internal records in case of non-individual shareholders.

FAQ 4: Does BEN-2 apply to foreign shareholders?

Yes. Foreign nationality is irrelevant. Same as Indian’s, even for a foreign individual who holds 10% or more indirect interest or control, BEN-2 applies.

FAQ 5: Is BEN-2 required every year?

No. BEN-2 is an event-based filing and is required only:

when an SBO is identified, or

when there is a change in SBO details.

Case-Based Examples

Case 1: Direct individual shareholding (No BEN-2)

Mr. A directly holds 20% shares in XYZ Pvt Ltd.

Result: Not an SBO → BEN-2 not applicable.

Case 2: Holding through LLP (BEN-2 applicable)

ABC LLP holds 30% shares in XYZ Pvt Ltd

Mr. B holds 60% profit share in ABC LLP

Indirect holding = 18%

Result: Mr. B is SBO → BEN-1 + BEN-2 applicable.

Case 3: Multiple partners in LLP

LLP holds 25% shares

Partner A: 40% → 10%

Partner B: 30% → 7.5%

Result: Partner A is SBO → BEN-2 applicable only for Partner A.

Case 4: Foreign company structure

Foreign Co holds 20% in Indian company

Mr. X (foreign national) holds 70% in Foreign Co

Indirect holding = 14%

Result: Mr. X is SBO → BEN-2 applicable.

Case 5: Trust holding

Trust holds 15% in Indian company

Trust is discretionary

Result: Trustee treated as SBO → BEN-2 applicable.

Final Practitioner Note

BEN-2 filing should always be supported by a documented SBO identification note. Incorrect filing or unnecessary filing may invite ROC scrutiny.

This article is intended for informational purposes for Indian companies, professionals, and compliance teams.