Introduction

Tax Deductors and collectors are permitted under the Income Tax law to rectify errors in filed TDS/TCS returns through correction statements. However, this facility is governed by a statutory limitation period.

In view of Section 397(3)(f) of the Income Tax Act, 2025, the Income Tax Department has clarified that 31 March 2026 is the final statutory cut-off date for filing TDS/TCS correction statements for certain earlier financial years. No correction statements shall be accepted beyond this date.

Applicability of cut off date of 31st March, 2026

TDS/TCS correction statements for the following periods can be filed only up to 31 March 2026::

- FY 2018-19 – Quarter 4

- FY 2019-20 to FY 2022-23 – Quarter 1 to Quarter 4

- FY 2023-24 – Quarter 1 to Quarter 3

All such statements shall become time-barred on 31.03.2026 and shall not be accepted from 01.04.2026 onwards.

Wordings of Section 397(3)(f) of the Income Tax Act, 2025:

The Income Tax Act 1961 stands repealed w.e.f 01.04.2026 by virtue of section 536 of Income Tax Act 2025.

Further, as per section 397(3)(f) of Income Tax Act, 2025, deductor/collector may deliver a correction statement in such form and verified in such manner as may be prescribed, to the prescribed authority within two years from the end of the tax year in which such statement is required to be delivered under the said clauses or under section 200 of the Income-tax Act, 1961.

Consequent to the above, correction statements for FY 2018-19 (Qtr. 4), FY 2019-20 to 2022-23 (Qtr. 1 to Qtr. 4) and FY 2023-24 (Qtr. 1 to Qtr. 3) shall be accepted only up-to 31st March 2026. The same are time barred by limitation on 31.03.2026 and would not be accepted from 01.04.2026 onwards.

What steps are required from the end of Tax Deductors?

This advisory requires immediate review of historical TDS/TCS filings. Any unresolved discrepancies, defaults, or errors relating to the above periods must be corrected before the limitation date.

Typical cases requiring TDS Corrections

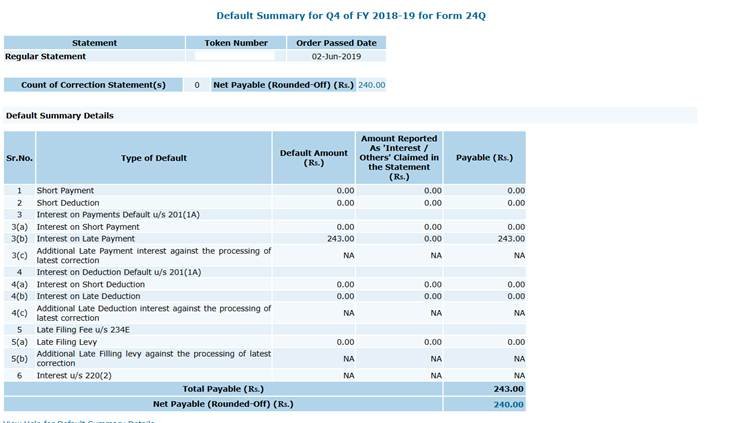

TDS Correction statement is required to be filed specifically in 2 cases:

- TDS Defaults are shown on traces portal; or

- TDS credit is not reflected in Form 26AS of the deductee

This may happen due to following reasons:

- Invalid or incorrect PANs in original statement

- Challan mismatch errors

- Wrong TDS section

- Short deduction

- Excess deduction not properly adjusted

- Deductee entries wrongly reported or omitted

How to check TDS defaults on TRACES

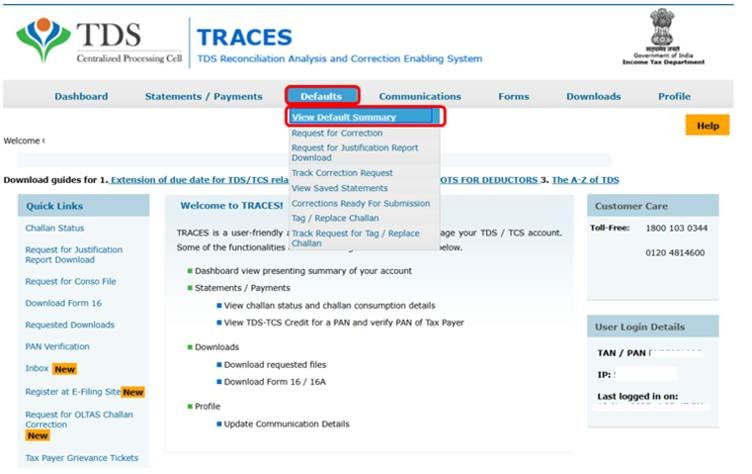

- Login to TRACES using valid credentials

- Go to Defaults>>View Defaults Summary

- Select Financial Year. Quarter can also be selected. Then click Go.

- Click the Quarter hyperlink to see the details.

- To find the detailed reasons for defaults, you can download the Justification Report from Defaults>>Request for Justification Report Download.

How to file TDS Correction Statements

There are two types of correction statements as follows:

- Online Correction: Applicable in cases where only PAN or Challan details are to be modified:

- Login to the TRACES portal

- Select quarter and financial year requiring correction

- Request correction under Defaults>> Request for Correction

- Fill the required details and ile using DSC or KYC.

- Offline Correction: Applicable where deduction entries are to be modified or challan addition and adjustment of deduction entries against it

- Download the Consolidated File from TRACES- Statements / Payments>>Request for Conso file

- Make corrections using the RPU.

- Upload the revised return on ITD portal using TAN Login

Consequences of Non-Compliance After 31.03.2026

Failure to act within the limitation period may result in:

- Permanent mismatch in deductee tax credits

- Continued interest, late fee, and penalty exposure

- Notices remaining unresolved without legal remedy

- Increased litigation and client dissatisfaction

Importantly, no condonation or relaxation is permissible once the limitation period expires.

Advisory & Recommended Action

- Conduct an immediate TDS/TCS reconciliation for FY 2018-19 onwards

- Identify pending defaults or unmatched entries

- File all required correction statements well before 31 March 2026

- Maintain acknowledgement and processing records for audit purposes

Conclusion

The limitation prescribed under Section 397(3)(f) of the Income Tax Act, 2025 brings final closure to past TDS/TCS corrections. With 31 March 2026 being the absolute statutory cut-off date, deductors and collectors must treat this as a critical compliance deadline.

Proactive review and timely corrections are essential to prevent irreversible tax credit issues and compliance exposure in the future.