Introduction

On February 1, 2026, Finance Minister Nirmala Sitharaman presented the Union Budget for the financial year 2026-27. This Budget introduced landmark reforms in direct taxation, focusing on simplification, rationalisation of tax rates, reduction of litigation, and incentivisation of investment. The centrepiece of these reforms is the Income Tax Act, 2025, which will replace the existing law from 1st April 2026.

Key Highlights

- Income Tax Act, 2025

- The Income Tax Act, 2025 will replace the Income Tax Act, 1961 from 1st April 2026.

- The new law has been designed to simplify provisions, reduce ambiguity, and introduce redesigned forms for easier compliance.

- Changes in TDS Rates

- Manpower supply services have been clarified as contractor payments, and TDS will now be deducted at 1% or 2%.

- Property purchases from non-residents will allow resident buyers to deduct TDS using PAN, eliminating the requirement of TAN.

- Form 15G and 15H can now be submitted to depositories for dividends, interest, and mutual fund income, making compliance easier for small taxpayers.

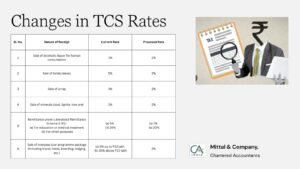

- Changes in TCS Rates

- The rate of TCS on overseas tour packages has been reduced to 2%, compared to the earlier 5% or 20%.

- The rate of TCS on education and medical remittances under the Liberalised Remittance Scheme (LRS) has been reduced to 2%, compared to the earlier 5%.

- The rate of TCS on liquor, scrap, and minerals has been increased to 2%.

- The rate of TCS on tendu leaves has been reduced from 5% to 2%.

Following is the detailed table of TCS rate changes:

| Sl. No. | Nature of Receipt | Current Rate | Proposed Rate |

| 1 | Sale of alcoholic liquor for human consumption | 1% | 2% |

| 2 | Sale of tendu leaves | 5% | 2% |

| 3 | Sale of scrap | 1% | 2% |

| 4 | Sale of minerals (coal, lignite, iron ore) | 1% | 2% |

| 5 | Remittance under Liberalised Remittance Scheme (LRS): (a) For education or medical treatment (b) For other purposes |

(a) 5% (b) 20% |

(a) 2% (b) 20% |

| 6 | Sale of overseas tour programme package (including travel, hotel, boarding, lodging, etc.) | (a) 5% up to ₹10 lakh (b) 20% above ₹10 lakh |

2%

|

- TDS Compliance Changes

- A fully automated online process has been introduced for issuing lower or nil deduction certificates, particularly benefiting small taxpayers.

- A one-time disclosure scheme called FAST-DS (Foreign Asset Disclosure Scheme) has been introduced to allow small taxpayers to declare undisclosed overseas assets or income.

- Changes for Companies (including MAT and other changes)

- The Minimum Alternate Tax (MAT) has been reduced from 15% to 14%, providing relief to corporates.

- The set-off of old MAT credit will now be allowed only in the new regime, and it will be capped at 25% of liability.

- Gains from buyback of shares will now be taxed as capital gains, resulting in higher effective tax for promoters (22% for corporates and 30% for non-corporates).

- The safe harbour margin for IT services has been fixed at 15.5%, and the threshold has been raised to ₹2000 crore.

- Changes for Co-operative Societies

- The scope of deductions available to co-operative societies has been expanded to include those engaged in the supply of cattle feed and cotton seed, thereby supporting rural and agricultural communities.

- Dividend income earned by one co-operative society from another has been allowed as a deduction under the new regime, encouraging inter-cooperative collaboration and reducing tax burden.

- Dividend income of notified national cooperative federations has been exempted, provided the investments are made up to 31st January 2026, which strengthens the financial viability of apex cooperative institutions.

These measures are designed to empower co-operatives, enhance their competitiveness, and ensure that they continue to play a vital role in supporting farmers, rural entrepreneurs, and community-driven enterprises.

- Tax Holidays

- Foreign companies providing global cloud services through Indian data centres will enjoy a tax holiday till 2047.

- Toll manufacturing in bonded zones will be eligible for a 5-year tax holiday.

- Global experts working in India will have their non-India income exempt for 5 years.

- Non-residents under presumptive taxation will be exempt from MAT.

- Incomes Made Exempt

- Interest awarded by the Motor Accident Claims Tribunal has been exempted from tax, and no TDS will be required.

- Disability pensions for armed forces and paramilitary personnel invalided due to disability have been fully exempted.

- Compensation received from compulsory land acquisition under the RFCTLARR Act, 2013 has been exempted.

- Capital gains on Sovereign Gold Bonds will be exempt only if they are subscribed at issue and held till maturity.

- Dividend income of notified national cooperative federations has been exempted for investments made up to 31st January 2026.

- Updated ITR Changes

- Pre-filled ITR forms will now cover more categories of taxpayers, reducing errors and simplifying filing.

- Revised and belated returns can now be filed until 31st March, subject to a nominal fee.

- Due Date Changes

- The due date for filing returns for non-audit businesses and trusts has been extended to 31st August.

- Audit cases will continue to follow the existing timelines.

- Penalty and Fine

- A common order for integrated assessment and penalty has been introduced to reduce multiplicity.

- The immunity framework has been extended to misreporting cases, subject to payment of 100% additional tax.

- Penalties for technical defaults such as audit reports and transfer pricing reports have been converted into fees.

- Minor offences have been decriminalised and converted into fines only.

- The maximum imprisonment for tax offences has been capped at 2 years, with minor offences attracting only fines.

- New penalties have been introduced for inaccurate reporting of cryptocurrency transactions.

- Safe Harbour Scheme

- The safe harbour scheme for IT and IT-enabled services has been updated, with the margin fixed at 15.5% and the threshold raised to ₹2000 crore.

- This scheme provides certainty in transfer pricing and reduces disputes for large service exporters.

Conclusion

The Direct Tax proposals in Budget 2026-27 represent a major step towards a simplified and transparent tax regime. With the introduction of the Income Tax Act, 2025, rationalisation of TDS and TCS rates, targeted exemptions, tax holidays for strategic sectors, and decriminalisation of minor offences, the government has created a taxpayer-friendly environment. These reforms are expected to boost compliance, attract investment, and strengthen India’s journey towards Viksit Bharat 2047.

BLOG BY : MITTAL & CO.