Introduction

The GSTN has issued an important Advisory & FAQs on 29 December 2025 introducing strict system-level validations for Input Tax Credit (ITC) reversal, ITC reclaim, and Reverse Charge Mechanism (RCM) ITC reporting in GSTR-3B.

With the implementation of the Electronic Credit Reversal and Re-claimed Statement and the RCM Liability/ITC Statement, GST compliance is now moving from disclosure-based to ledger-based auto-controls. Shortly, negative balances and excess ITC claims will not bepermitted, and GSTR-3B filing will be blocked unless discrepancies are corrected.

What is the Electronic Credit Reversal and Re-claimed Statement?

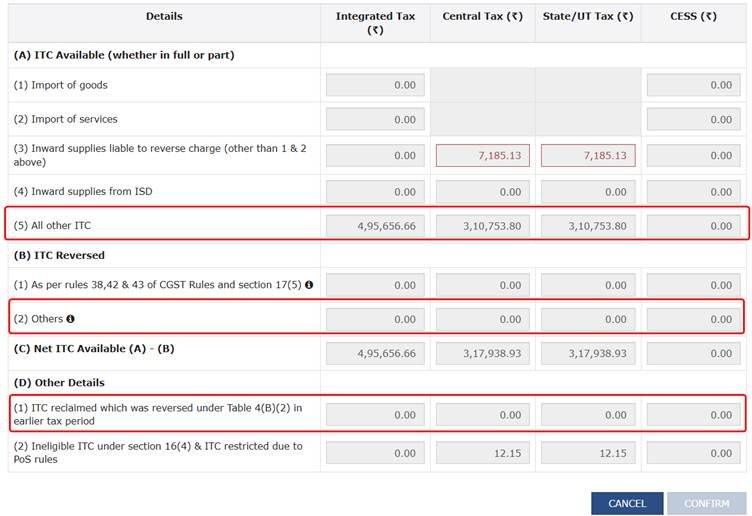

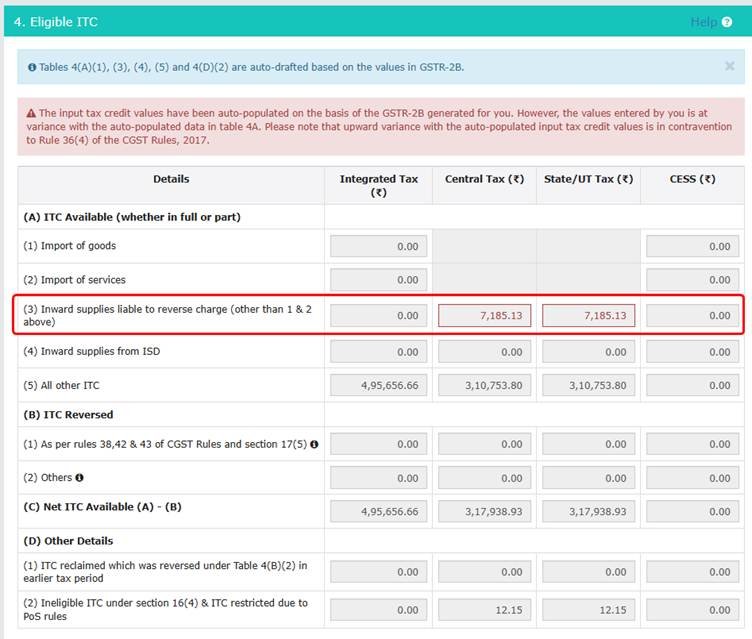

GSTN introduced the Electronic Credit Reversal and Re-claimed Statement in August 2023. It tracks temporary reversal of ITC and re-claim of the same on fulfilment of certain conditions. It captures the data from GSTR 3B- Table 4B(2)- temporary reversal of ITC and Table 4D(1) and 4A(5)- reclaim of ITC.

Path to view:

Dashboard → Services → Ledger → Electronic Credit Reversal and Re-claimed

Cases where temporary ITC reversals and re-claims are made:

Temporary ITC reversals and re-claims are typically required in following cases:

- Non-reflection of ITC in GSTR 2B for the period: ITC is initially calculated on the basis of invoices entered in the books of accounts. However, some of the invoices may not be reflected in the GSTR 2B for such period. This can happen due to non-filing of GSTR 1/ IFF by the supplier or incorrect reporting of the recipient’s GSTIN. As GSTR 2B is static statement, if supplier files his GSTR 1/ GSTR 1A after 13th day of the month, such ITC is reflected in the next month. This results into temporary reversal of such ITC in the current month. Such ITC shall be reclaimed in the month in which it is reflected in GSTR 2B.

- Non-payment of the supplier within 180 days of the invoice date: As per Rule 37 of CGST Rules, if payment (value of supply + GST) is not made to the supplier within 180 days from the date of invoice, the ITC availed earlier must be temporarily reversed along with interest. Such ITC can be re-claimed once the payment to supplier is made.

- ITC Reversal Pending Receipt of Goods or Services: ITC is eligible only after receipt of goods or services to the recipient. If ITC is availed on the basis of purchase invoice and GSTR 2B, but the goods are not received yet (goods-in-transit or delayed delivery), it must be temporarily reversed. It should be claimed in the month of delivery.

New GSTN Validations Impacting GSTR-3B Filing

GSTN has clarified that negative balances or excess ITC availment will soon not be allowed.

ITC reclaimed in Table 4(D)(1) must be less than or equal to:

- Closing balance of ITC Reclaim Ledger plus

- ITC reversed in Table 4(B)(2) of the same return period

Excess reclaim beyond this limit will block GSTR-3B filing.

What is the RCM Liability/ITC Statement under GST?

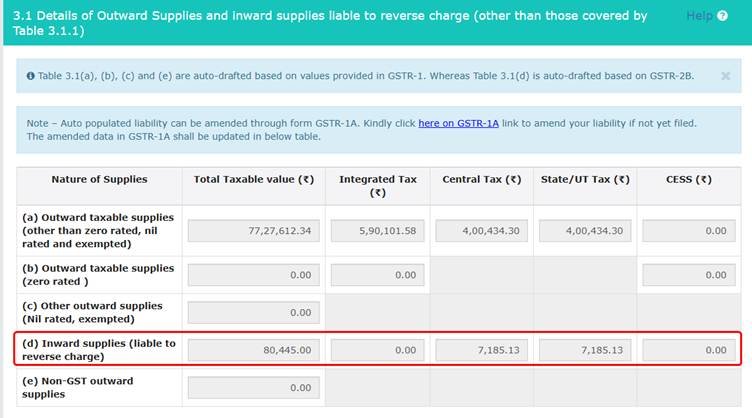

To streamline reporting under Reverse Charge Mechanism (RCM), GSTN introduced the RCM Liability/ITC Statement in August 2024.It captures RCM liability declared in Table 3.1(d) of GSTR-3B and ITC claimed in Table 4A(2) and 4A(3).

Path to view:

Services → Ledger → RCM Liability/ITC Statement

New Validation for RCM ITC Claim in GSTR-3B:

RCM ITC claimed in Table 4A(2) and 4A(3) must be less than or equal to:

- RCM liability paid in Table 3.1(d) of the same return period plus

- Closing balance of the RCM Liability/ITC Statement

Any mismatch will result in non-submission of GSTR-3B.

4. How to file GSTR-3B if closing balance of Electronic Credit Reversal and Re-claimed Statement (ITC reclaim ledger) is already Negative?

If the closing balance of the ITC reclaim ledger is negative, it indicates that excess ITC was reclaimed earlier. Therefore, to file GSTR-3B, you must reverse the excess claimed ITC in Table 4B(2) of the respective return period, up to the amount of the negative closing balance. This will allow you to correct the discrepancy and proceed with filing the return. In case there is no ITC available, this reversal declared in table 4(B)2 will be added to your liability in current period while filing GSTR-3B.

Example: The closing balance of the ITC reclaim ledger for the current return period is -₹10,000, which means ₹10,000 of excess ITC has been reclaimed in earlier periods. To file your GSTR-3B, you would need to reverse this earlier excess reclaimed ITC of ₹10,000 in Table 4B(2) for the current period.

How to file GSTR-3B if closing balance of RCM Liability/ITC Statement is Negative?

If the closing balance of the RCM Liability/ITC Statement is negative, it indicates that excess RCM ITC has been claimed earlier. To proceed with filing, you must either pay the outstanding RCM liability in Table 3.1(d) or reduce the ITC being claimed in Table 4A(2) or 4A(3) in the current return period, equivalent the amount of the negative closing balance. Once the discrepancy is corrected, you will be able to file your return.

Example:

Let’s assume that the closing balance of the RCM Liability/ITC Statement is -₹5,000. This means that ₹5,000 of excess RCM ITC has been claimed earlier. To resolve this and file your GSTR-3B, you can:

1. Pay the RCM liability: You can pay additional ₹5,000 in Table 3.1(d) for the current return period to cover the excess ITC claimed.

OR

2. Reduce the ITC claimed: You can reduce ₹5,000 from the RCM ITC in Table 4A(2) or Table 4A(3) for the same period, if RCM ITC is available more than ₹5,000 in current period.

Once either the excess RCM liability is paid or the requisite ITC is reduced from available ITC to match the available negative closing balance, the discrepancy will be resolved, and you can proceed with filing your return.

Conclusion

The GST Advisory dated 29 December 2025 signals a major shift towards automated ITC governance. With ledger-based validations becoming mandatory, taxpayers must ensure real-time reconciliation of ITC reversals, reclaims, and RCM transactions.

Businesses should immediately review their ITC Reclaim Ledger and RCM Liability/ITC Statement, rectify negative balances, and align GSTR-3B reporting to avoid return filing disruptions, interest, and penalties.