Introduction

Changing employment during a financial year is increasingly common among salaried taxpayers. However, many employees face an unexpected additional income tax liability at the time of filing their Income Tax Return, even though TDS has been deducted by both the previous and current employers. This additional tax payable primarily arises due to independent TDS computations, progressive slab rates, and non-consolidation of salary income during the year.

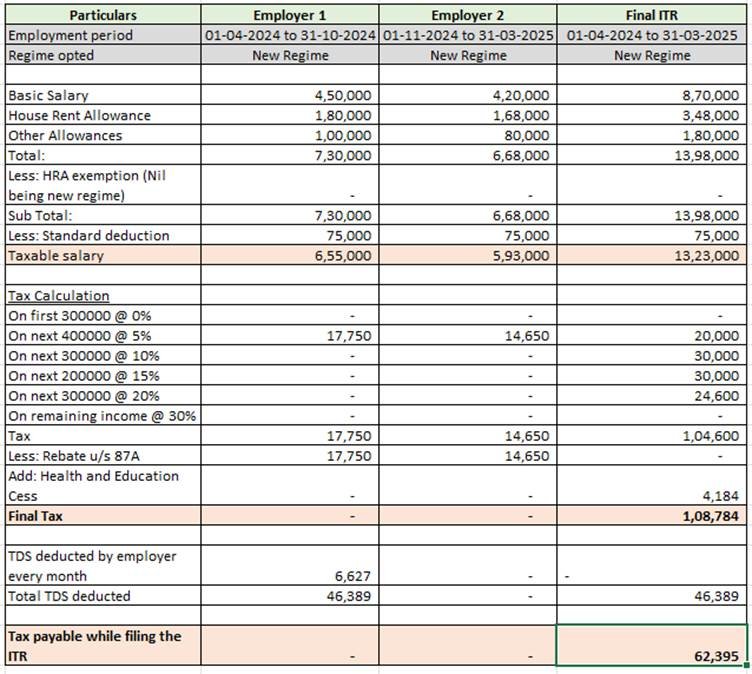

Let’s understand the how the exact calculations are done in such cases.

1. Independent computation of TDS by multiple employers

Under Section 192 of the Income-tax Act, 1961, an employer is required to deduct TDS based only on the salary paid by it. There is no flat rate of TDS in case of salary payment. Income Tax Act states that total TDS by the employer during the year should be equal to the tax liability of the employee on his salary income received from such employer after considering investment declaration. Being an Individual, tax is calculated at slab rates.

When an employee changes jobs, each employer computes TDS independently without automatic visibility of salary paid by the other employer.

Ideally, employee should submit Form 12B to the new employer which declares details of salary paid by previous employer. However, it is not mandatory form and employees do not prefer disclosing such information to the new employer. Therefore, due to non-submission of Form 12B to the new employer, salary income and TDS of the previous employment are not considered, resulting in short deduction of tax for the year.

2. Impact of progressive tax slab rates on combined income

India follows a progressive tax rate structure, where higher income attracts higher tax rates. While salary from each employer may individually fall within a lower tax slab, the aggregate annual salary may fall into a higher slab (for example, 20% or 30%).

Since slab-wise tax is applied on total income at the time of ITR filing, the difference between tax actually deducted and tax payable becomes recoverable from the taxpayer.

3. Duplication of standard deduction under Section 16(ia)

The standard deduction under Section 16(ia) (Rs. 50,000 for old regime and Rs. 75,000 for new regime) is allowed only once from total salary and not separately for each employer. However, during a job change, both employers may allow the standard deduction while computing TDS.

At the time of filing the return, the Income Tax Department allows this deduction only once, thereby increasing taxable salary income and leading to additional tax liability.

6. Mismatch in tax regime selection (Old vs New Regime)

During job changes, employees may opt for a different tax regime with the new employer under Section 115BAC, without aligning it with the final choice made while filing the ITR.

Differences in available exemptions, deductions, and slab rates between the old and new tax regimes may lead to variance in tax liability and additional tax payable.

Example:

Mr. A has changed the job during the year. Following are the details:

How to Avoid Additional Tax Liability When Changing Jobs

- Submit Form 12B promptly: Provide complete and accurate details of salary, perquisites, and TDS from the previous employer to the new employer to enable correct TDS computation under Section 192.

- Estimate total annual income in advance: Periodically consolidate salary from all employers to assess the correct tax slab and avoid under-deduction of TDS.

- Choose the correct tax regime consistently: Align the tax regime option (old or new under Section 115BAC) selected with the employer with the final choice at the time of filing the ITR.

- Declare deductions and exemptions early: Intimate eligible deductions (such as Chapter VI-A) and exemptions to the employer in a timely manner to ensure accurate TDS.

- Opt for higher TDS or pay advance tax, if required: Where a shortfall is anticipated, voluntarily pay advance tax or request higher TDS to avoid interest under Sections 234B and 234C.

Conclusion

Additional income tax payable in case of a job change arises mainly due to fragmented salary information, duplicate deductions, and independent TDS calculations by employers. This is a compliance issue rather than a tax demand anomaly.

To avoid unexpected tax liability, employees should ensure timely submission of Form 12B, reconcile Form 16 from all employers, evaluate the appropriate tax regime, and periodically review their total annual income. Proactive tax planning during a job transition helps in optimizing tax liability and avoiding interest and penalties at the time of filing the ITR.